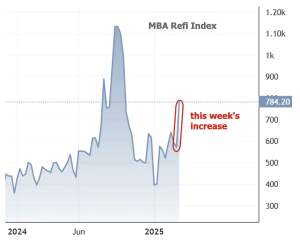

The mortgage market just got a breath of fresh air as refinance (refi) demand surged to its highest level since October, all thanks to lower interest rates.

Why the Sudden Jump in Refi Applications?

Last week, we predicted that the Mortgage Bankers Association (MBA) data hadn’t yet captured the full impact of falling rates. This week’s numbers proved that to be true—homeowners took advantage of the dip, pushing the refi index up significantly.

Rates have now settled back into levels we last saw in mid-October. But what’s interesting is that we didn’t see this kind of spike in refinancing activity back in early December when rates were in the same range. This suggests that borrowers are more sensitive to the overall trend rather than just a single rate drop.

Refinance Boom—But Not Like the Past

It’s important to note that while refinance activity has picked up, it’s still nowhere near the levels we saw in past rate rallies. Homeowners who locked in ultra-low rates during the pandemic era still have little incentive to refinance unless they’re tapping equity or restructuring debt. That said, for borrowers with higher-rate loans, this drop presents a solid opportunity to lower monthly payments or switch loan products.

What About Homebuyers?

Unlike refinancing, home purchase demand isn’t as reactive to short-term rate fluctuations. The MBA’s purchase index held steady, showing no major shifts in buyer behavior. This continues a two-year trend where home sales remain largely unaffected by temporary rate dips, as affordability and inventory constraints still play a bigger role in the market.

Should You Refinance Now?

If you’ve been considering a refinance, now is the time to run the numbers. A rate drop could mean thousands in savings over the life of your loan, but factors like closing costs, loan term, and future rate expectations should all be considered.

Have questions about whether refinancing makes sense for you? Let’s talk—Femme Capital Partners is here to help you make the smartest financial moves.