The bond market had a rollercoaster start to the week, initially facing a weaker overnight session before bouncing back strongly following the release of the ISM Manufacturing data this morning. While the headline numbers were roughly as expected, it was the weaker employment and new orders figures that sparked a positive shift in bond prices.

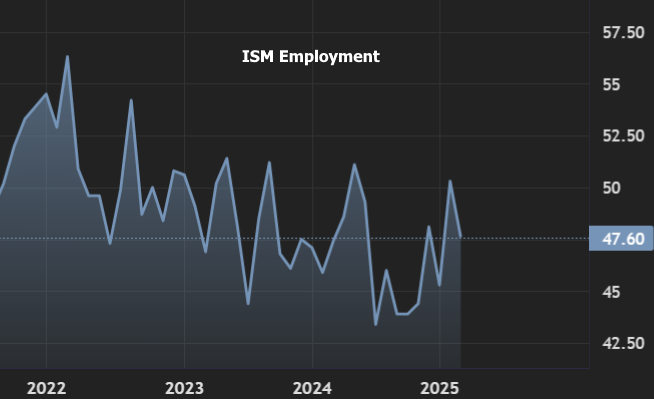

The ISM Manufacturing Index showed a slight decline to 50.3 from the previous 50.9, but it was the details that caught the market’s attention. Employment dropped to 47.6, well below the forecast of 50.1, signaling a slowdown in job growth within the manufacturing sector. Similarly, new orders fell significantly, dropping to 48.6 from 55.1, far below expectations.

These weaker figures outweighed the more inflationary “prices paid” component, which surged to its highest level in over two years at 62.4. The market reacted swiftly—within just 15 minutes, the initial losses reversed into moderate gains, and by mid-day, bonds continued to strengthen, driven mainly by the economic data rather than any other news developments.

Here’s a recap of the key economic data:

- ISM Manufacturing Index: 50.3 vs. forecasted 50.5, previous 50.9

- ISM Prices Paid: 62.4 vs. forecasted 56.2, previous 54.9

- ISM Employment: 47.6 vs. forecasted 50.1, previous 50.3

- ISM New Orders: 48.6 vs. forecasted 54.6, previous 55.1

Market movements followed a similar trajectory. At 10:09 AM, bonds bounced back to positive territory after the ISM data, with MBS (Mortgage-Backed Securities) unchanged and the 10-year Treasury yield dropping by 2.1bps to 4.194%. By 1:10 PM, stock market losses spilled over, providing further support for bonds, and the 10-year yield dropped further to 4.174%. By 3:22 PM, the market reached its best levels of the day, with the 10-year down 5bps at 4.165%, marking an overall positive shift.

So, what does this mean for mortgage rates? As bonds strengthen, mortgage rates generally benefit, and we’ve seen a clear positive reaction in the bond market today. While the movement is subtle, it could be an indicator of future rate stability, especially if the economic data continues to show signs of a slowdown.

For those in the market for a mortgage, whether buying a home or refinancing, this might be a good opportunity to lock in favorable rates. However, it’s always important to stay on top of upcoming economic reports, as they can cause shifts in the market at any time.

Stay informed, and feel free to reach out if you have any questions about how these market movements may impact your mortgage options. At Femme Capital Partners, we’re always here to provide you with the latest insights and guide you through your financing journey.