Will Mortgage Rates Drop After This Week’s Fed Meeting? Here’s What You Need to Know

The Federal Reserve is back in the hot seat this week, and if you’ve been waiting for mortgage rates to finally take a meaningful dip

The Federal Reserve is back in the hot seat this week, and if you’ve been waiting for mortgage rates to finally take a meaningful dip

The foreclosure landscape is shifting — and this time, it’s a win for everyday buyers and investors. On April 28, 2025, the Federal Housing Administration

Back in late June, the U.S. made headlines with targeted airstrikes on Iranian nuclear facilities—a major geopolitical flashpoint that many feared would rattle the global

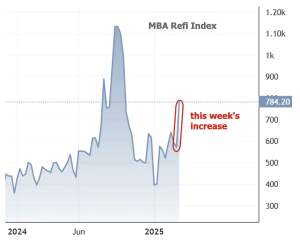

The mortgage market just got a breath of fresh air as refinance (refi) demand surged to its highest level since October, all thanks to lower

The bond market had a rollercoaster start to the week, initially facing a weaker overnight session before bouncing back strongly following the release of the

When it comes to mortgage rate options, one of the most common is the fixed-rate mortgage, like some of the loan programs provided by the

Are you in the market for a new home and looking to apply for a home loan? Applying for a home loan can be a

Are you interested in purchasing or refinancing a home? Are you familiar with the home loan process and confident in your ability to navigate it?

Femme Capital Partners is a company by women for women. We understand the challenges that women and minorities face when it comes to their financial